Claims and Appeals

A Historical Perspective

Since the middle ages and the establishment of the guilds, people have banded together to protect the economic security of others. Guilds not only regulated a particular trade, production, and performance of craft but also protected its members in times of illness and death.

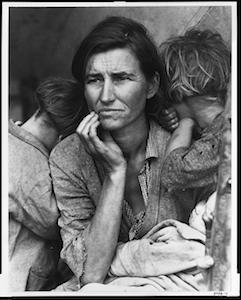

Eventually, governments began to assume responsibility for its poorer citizens. In early England, almshouses were built to provide a shelter for the poor and sick. In the 1500s, England created and passed “poor laws” (something we now call “welfare laws.”) The “poor laws” were designed to give economic relief to those who were deemed by local communities to be “deserving.” (The corollary to this designation was that there were people who were also found to be “undeserving.”) There was no standardized system to determine who received benefits. In the early days of poor relief in England, the government made the receipt of state benefits as unpleasing as possible to its beneficiaries. The reasons for making receipt of benefits harsh is because of the belief that if it were unpleasant or harsh to receive poor relief from the government, recipients would become productive members of society. An additional reason for the dour treatment was the belief that the poor were the cause of their poverty. By the mid 19th century, England passed a law which mandated that anyone who received poor relief must live in a workhouse. Charles Dickens, in his novel, Oliver Twist, written in 1837, excoriated the conditions of the workhouses especially their inhumane impact on the young.

The system of poor relief was “imported” to the United States by our original English settlers, bringing with them the system of workhouses and poorhouses. Eventually, a system developed by which a person who was living outside of a workhouse could receive poor relief. This relief was called “outside relief.” Outside relief was not favored (presumably because it was thought to be too lenient) but it was found to be less expensive.

Pension programs developed in our country for soldiers before the start of the Revolutionary War. But during the Civil War, the government established its first formal system of government benefits for widow and orphans of soldiers who died in the war. The government also created a disability system for soldiers who were disabled in the war. Eventually, the government removed the predicate that the death or disability must be service connected. At the end of the 19th century, the pensions and other government benefits received by soldiers, widows, and orphans were over 30% of the federal budget.

Many pension and welfare plans were discussed, offered and rejected at the beginning of the 20th-century before and after the stock market crash of October 29, 1929. However, the plan which became law was the Social Security Act. The Social Security Act was signed into law on August 14, 1934, by President Franklin D. Roosevelt. This initial law did not cover medical or disability payments. Taxes funded the system under the Federal Insurance Contributions Act (known as FICA). Under FICA, more than $8.7 trillion has been collected, and over $7.4 trillion has been paid out. The taxes collected under FICA go into a special trust fund for the purpose of paying benefits under the program.

An amendment to the Social Security Act in 1954 added a “disability freeze” to the law. This provision paid no cash benefits. Instead, the “disability freeze” prevented the inclusion of zero years of income in the computation of retirement benefits for the years that the person was unable to work. In 1956 the Act was amended again to allow disabled workers and disabled adult children to receive benefits. The 1956 amendment was age limited, only allowing workers between the ages of 50-64 the right to receive benefits (although disabled adult children could receive benefits as well). By 1960 around 559,000 people were receiving disability benefits. The average benefit was about $80 per month. Between 1961 to 1969, the number of people receiving disability benefits increased from 742,000 to 1.7 million.

In 1972 an additional category of disability was added. The category was called Supplemental Security Income or SSI. The design of the SSI program was to provide a federal welfare for persons who are disabled and poor.

As of 2016, there were 2,321,583 applications for Social Security worker disability. In that same year, about 32.06% (744,268) of all applications resulted in an award. These statistics represented a decrease over 2015 by 4.06% and a substantial decrease from 2010 when there were 2,935,798 applications. 35.85% of the applicants in 2010 received awards for disability.

At the end of 2016, 8,808,736 people received Social Security disability benefits. This number represented a 1.13% decrease in the number of people receiving disability benefits from 2015. The 2016 decrease made 2016 the first year in the 2000 s in which there was a decline in the number of persons receiving disability benefits. The 2016 year also showed the highest number of terminations, 830,444, in the 2000s. The termination rate for 2016, 8.81% was also the highest rate for terminations in the 2000s.